Silver Dollars: What Are They Worth?

Learn how to compute the value of US silver dollars. It is not as easy as you think.

Enchanting, aren’t they? Silver dollars. They remind us of days gone by, when people were authentic, and so was their money.

In the United States, most people have seen Morgan silver dollars: those big, bold, beautiful coins named after their designer, George T. Morgan. But you may also recall Peace silver dollars, which show Miss Liberty in radiant headdress plus a perched eagle on the back.

What are they worth? You will find out here. It takes some effort and a lot of seat-of-the-pants reckoning to get reliable results. There are 6 steps.

The Morgan in our picture below has a crisp, white obverse (the “heads” side), and a rainbow-toned reverse (the “tails” side). That coin is worth between $20 and $40 US dollars. Collectors who seek out toned coins might pay even more than $40.

This Peace dollar below is especially nice looking. You don’t see nice ones very often. The pictured coin evaluates about the same as the Morgan above, between $20 and $40.

There are six steps necessary to evaluate these coins.

Base Value (BV)

Date and mint mark

Condition

Catalog value

Adjustments to catalog value

The final number

Base Value (BV) - I am sure you realize that today’s “silver” dimes, quarters, and half dollars contain no silver at all. Precious metal in currency vanished long ago, in the mid 1960s, and the United States has operated on fiat currency ever since. “Fiat” means “government decree,” and the only reason a dollar is worth a dollar is because the government says so. Scary, huh?

Before the mid 1960s, we used commodity-backed currency, and the commodity of choice was silver. Remember the old Silver Certificates? The inscription read “One dollar in silver payable to the bearer on demand.” But not anymore. Nothing is payable on demand these days.

Years ago, with Morgan and Peace dollars, you held the silver in your hand and that gave the money its value. Today, Morgan and Peace dollars are worth much more than one dollar. That’s because they contain silver which is very valuable these days.

How much silver is there in a Morgan dollar? In a Peace dollar?

0.773 troy ounces of silver in a Morgan dollar

0.773 troy ounces of silver in a Peace dollar

And how much is that silver worth today? You have to look it up.

Go online to web sites such as Kitco.com to find the current price of silver. It changes constantly.

Let’s say that Kitco says the current price of silver is $20 US dollars per troy ounce. The silver in a Morgan or Peace dollar is worth 0.773 times that much. We call it “Melt Value,” “Bullion Value,” “Base Value,” or simply “BV.”

BV = 0.773 x [current price of silver]

For silver trading at $20 US dollars per troy ounce, BV of a Morgan or Peace dollar is $20 x 0.773 = $15.46. For silver trading at $30, BV increases to $23.19. If it’s $40 silver, BV = $30.92, and so on. A Morgan or Peace dollar can never be worth less than its BV, but it can be worth more.

Aside: When dealing with ounces of precious metal like gold and silver, the term “troy” is understood. So, 5 ounces of gold weighs 5 troy ounces, not 5 avoirdupois ounces as measured on the kitchen scale. Be careful about this when dealing with someone you don’t know. Web sites like Kitco.com use troy ounces, even though the word “troy” is not stated explicitly.

Date and Mint Mark - It is hard to miss the date on the obverse,

Morgan dollars are dated from 1878 to 1921

Peace dollars are dated from 1921 to 1935

but it is easy to miss the mint mark. Mint marks are tiny letters found on the reverse side. They represent the mint which manufactured the coin: S for San Francisco, CC for Carson City, O for New Orleans, and so forth. Sometimes there is no mint mark at all. This means the coin was minted in Philadelphia.

Better get your magnifier out when deciphering mint marks, especially those on Peace dollars. It can be difficult to tell, for instance, the difference between a D (Denver) and an O (New Orleans) mint mark.

Together, the date and the mint mark define a particular coin. They are written as such, so an 1883 Morgan dollar with a CC mint mark is written 1883CC.

Condition - Along with date and mint mark, another factor that directly affects the values of Morgan and Peace dollars is their condition.

Numismatists (those who collect and study coins) have developed a very detailed scale for specifying the condition, or grade, of a coin. The numismatic scale has more than 30 separate levels, and it combines numeric values with certain adjectives to indicate the state of preservation of individual coins. In numismatic literature, you will see grades such as Very Good 8 (VG-8), Extra Fine 40 (EF-40), and Mint State 65 (MS-65). This is overkill for our purposes. Evaluating rare coins is not an exact science, even though a scale with 30+ grading levels indicates that it is. Instead of 30+ levels, we use four, shown here:

To get an estimate of the value of your silver dollar, you must estimate its condition. Use the pictures. Is your coin worn (which corresponds to numismatic grade G-4), average circulated (VF-20), well preserved (EF-45), or fully uncirculated (MS-63)?

Notice that to reach the lofty grade of fully uncirculated, a coin must be in a numismatic slab. This is a protective, hermetically sealed plastic holder which keeps the environment away from the coin, including unruly, potentially greasy, fingers. Hence the term “uncirculated.” In contrast, circulated coins have seen the wear and tear of everyday use. Collectors with deep pockets can afford uncirculated coins, but most are happy to collect nice-looking circulated specimens, which cost much less.

Catalog Value - If you know anything about rare coins, you know about catalog values. These are the values you see published in books, magazines, and web sites. They give a very rough idea (albeit inflated) of the value of a coin by date, mint mark, and condition.

You can look up catalog values using resources such as the PCGS Price Guide and the Red Book, but we have prepared simple tables of catalog values which are accurate and very easy to use. The dates and mint marks are separated into groups. Hope you have the good ones!

Morgan dollars: two tables of catalog values by date, mint mark and condition:

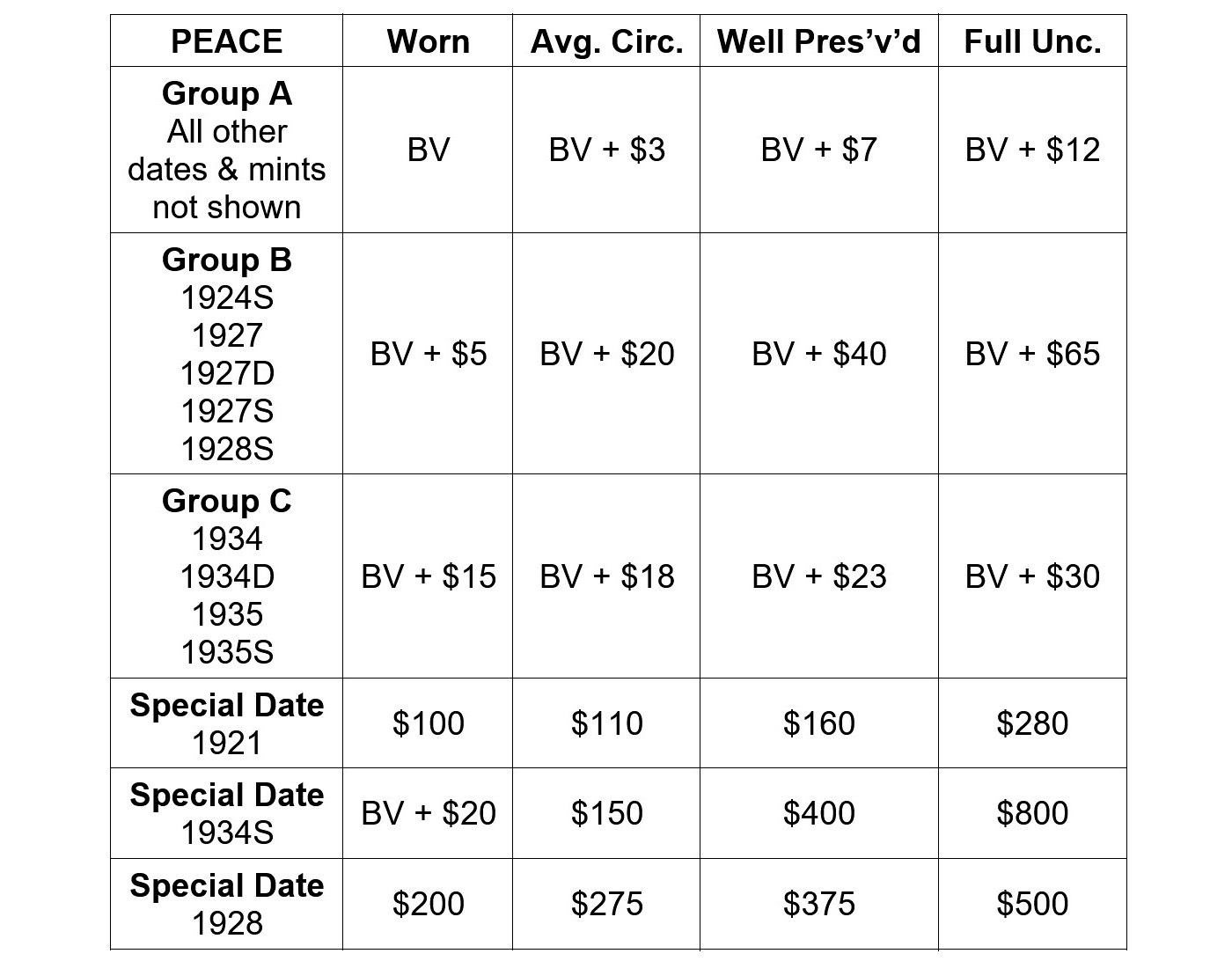

Peace dollars: one table of catalog values by date, mint mark and condition:

Once you have computed the current BV for your coin (see above), once you have its date and mint mark, and once you have estimated your coin’s condition, use the tables to look up the catalog value for your coin. This is the first step in estimating value. But you are not done yet. There are two more steps necessary to figure out the actual retail or wholesale value of your silver dollar.

Adjustments to catalog value

The final number

Adjustments to catalog value - Here’s where it gets tricky. This is material you won’t see in most coin pricing guides. Three factors strongly affect the value of a particular coin, and you must take these factors into account to get accurate estimates of value. You do this by moving the catalog value (obtained from the tables above) up or down. Most of the time, the adjustment is down, but sometimes the catalog value is raised.

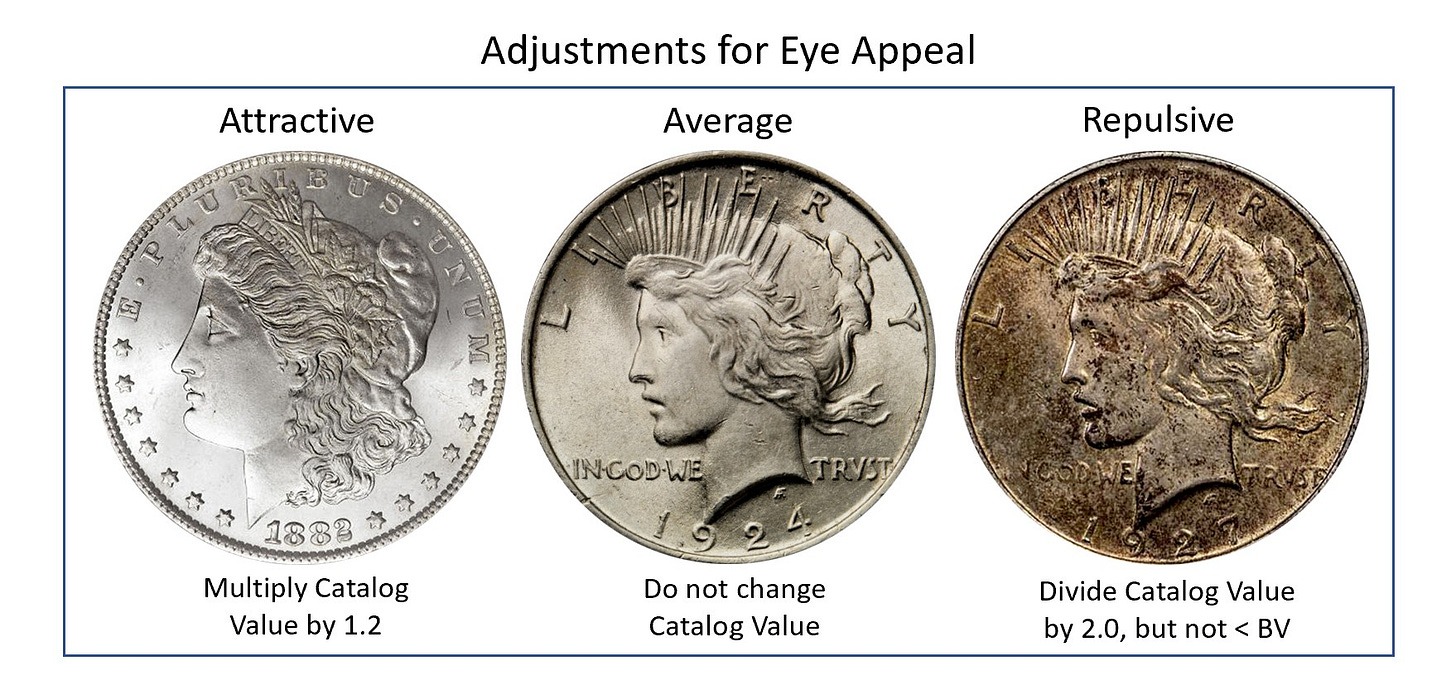

Eye Appeal captures the overall beauty and allurement of one particular coin compared to other coins. Eye Appeal is not the condition or grade of the coin, but it is the coin’s visual attractiveness when viewed simultaneously with other coins. Indeed, coins with exactly the same grade can have vastly different eye appeals. Collectors, of course, are willing pay more for coins that are pleasing to look at compared to coins that spurn the eye. The catalog value adjusts up or down accordingly.

Use the pictures above to adjust catalog value for Eye Appeal. For very attractive coins, increase catalog value by 20 percent. For unattractive coins, decrease catalog value by a factor of 2. Remember, however, that silver dollar can never be worth less than their silver content, so don’t let your catalog value decrease below BV.

Eye Appeal is an elusive parameter when it comes to evaluating rare coins, including silver dollars. Equally elusive, possibly more elusive, is the Cleaning status of rare coins. For some reason, steeped, no doubt, in tradition, coin collectors carefully avoid coins that have been cleaned or polished by someone in an effort to improve Eye Appeal. If a collector detects that a coin has been cleaned, he or she will not buy it. A cleaned coin is worth almost zero. Some died-in-the-wool collectors will not even pay BV for a cleaned coin.

Detecting cleaned coins comes with experience. If you hear “That coin is beautiful. It is nice and shiny!” watch out. It has probably been harshly cleaned with chemicals or abrasives. What you want to hear is how “lustrous” or “frosty” the coin appears, not how “shiny” it is.

Crooks like to fool collectors by cleaning coins with subtle mechanical and chemical techniques that alter the coin’s surfaces. One technique, called whizzing, uses small steel brushes to impart luster to an otherwise worn coin. Be careful. Don’t buy expensive coins from someone you do not trust.

The last category of catalog value adjustment is Damage. Damaged coins are easy to detect. Strong damage wipes out a coin’s value.

There are many types of damage. Coins mounted as jewelry are not collectible as coins, and should be appraised by a jeweler, not a numismatist.

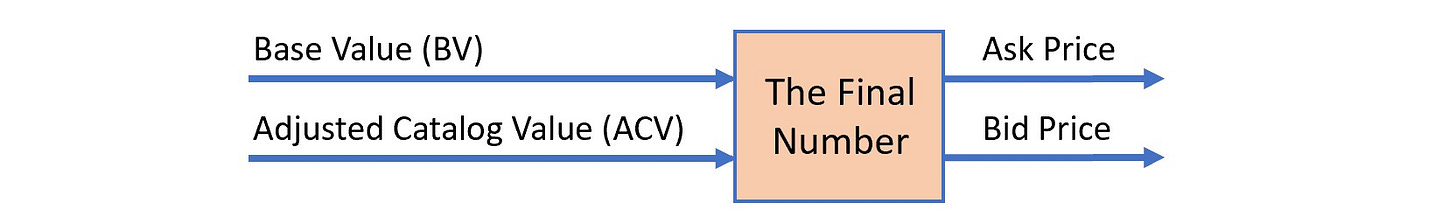

The Final Number - When people ask “What is my coin worth?” they usually mean “What can I sell it for?” The answer depends on who you sell it to.

If you are selling your coin directly to a collector, you are selling it at the Ask price. If you are selling your coin to a coin dealer, you are selling it at the Bid price. Bid is always less than Ask, and the difference between them is called dealer spread. It is the margin dealers use to keep their businesses afloat.

Some people think of the Ask price as the retail price, and the Bid price as the wholesale price. Put yourself in a dealer’s shoes. Ask price is what you are asking people to pay for your product. Bid price is how much you are willing to pay to obtain products to sell.

It is a mistake to think your coin is worth catalog value or even Adjusted Catalog Value (ACV). It isn’t. Bid and Ask prices are different than catalog values, but there are rule-of-thumb formulas which relate the two.

Here are the formulas. First, for bullion pricing, when the Adjusted Catalog Value (ACV) is about equal to the Base Value (BV):

Ask = 1.8 x ACV

Bid = 0.6 x Ask

The 1.8 factor in bullion pricing is called the premium. In times of political turmoil, the factor can be more than 1.8. In calm, peaceful times, the factor usually falls to about 1.2.

For numismatic (coin collector) pricing, when ACV is significantly greater than BV:

Ask = 0.8 x ACV

Bid = 0.6 x Ask

Knowledgeable collectors rarely pay full catalog value for coins they buy. They know that catalog values are inflated over actual market prices.